LAS VEGAS SANDS (LVS)·Q4 2025 Earnings Summary

Las Vegas Sands Crushes Q4 as Singapore Delivers Record EBITDA; CEO Rob Goldstein Transitions to Advisor

January 28, 2026 · by Fintool AI Agent

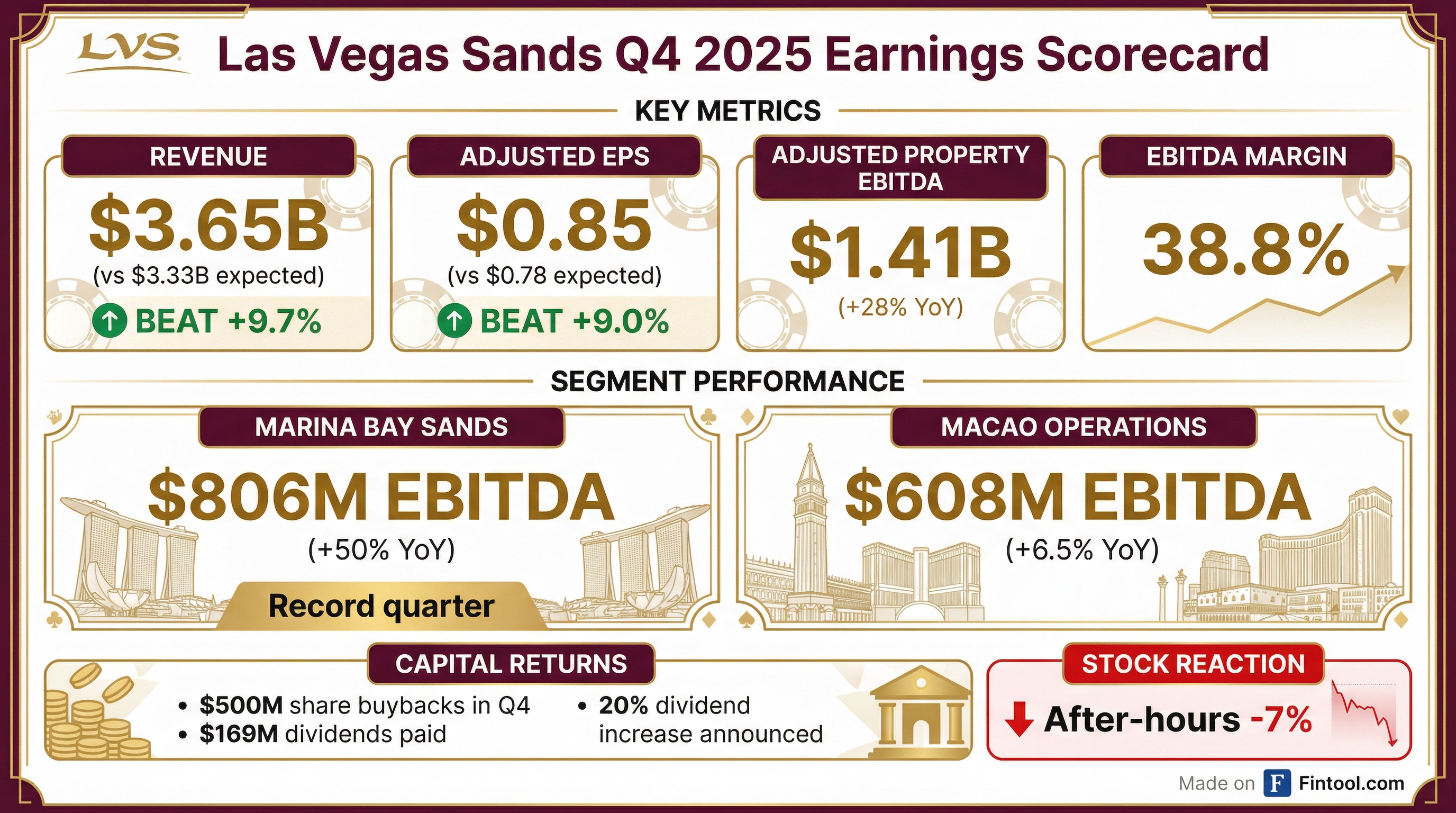

Las Vegas Sands delivered a strong Q4 2025, beating both revenue and earnings estimates as Marina Bay Sands posted what CEO Rob Goldstein called "the greatest quarter in the history of casino hotels." Revenue jumped 26% year-over-year to $3.65 billion, while adjusted EPS of $0.85 topped the $0.78 consensus by 9%. The company also announced Goldstein will transition to a senior advisor role after 30 years, marking the end of an era.

Did Las Vegas Sands Beat Earnings?

Yes — on both metrics. LVS delivered its fourth consecutive earnings beat, extending a winning streak that began in Q1 2025.

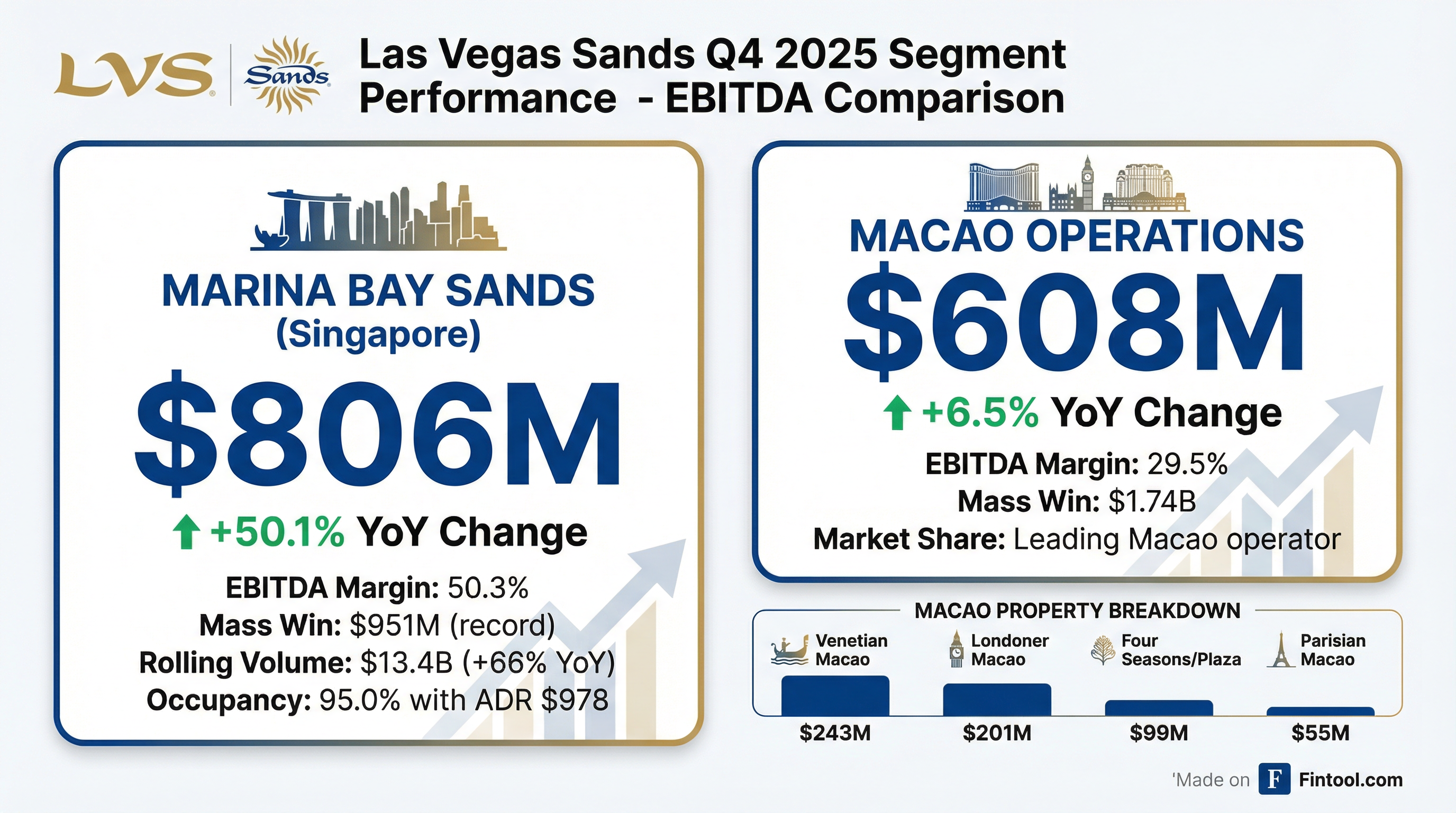

The beat was driven almost entirely by Singapore, where Marina Bay Sands delivered $806 million in Adjusted Property EBITDA — a record quarter and up 50% year-over-year.

Recent Beat/Miss History:

What Drove the Strong Results?

Marina Bay Sands: "The Greatest Quarter in the History of Casino Hotels"

Singapore delivered a standout quarter, with Adjusted Property EBITDA of $806 million at a 50.3% margin. CEO Rob Goldstein was emphatic about the achievement:

"Marina Bay Sands delivered an EBITDA of $806 million, simply the greatest quarter in the history of casino hotels. We exceeded $2.9 billion in EBITDA this year... There has never been a building, to my knowledge, that delivered these types of results."

Key drivers:

- Mass gaming exceeded $951 million, up 118% from Q4 2019 and 27% from Q4 2024

- Hold on rolling play was favorable, adding $45 million to EBITDA versus expected hold

- Higher tax rate triggered — MBS hit the higher mass gaming tax rate in July, with approximately $44 million impact in Q4

On sustainability, Goldstein acknowledged the difficulty in forecasting: "We've proven to be very bad at forecasting this... Last year I said $2.5 billion was our goal, and people thought that was very ambitious. It proved to be very unambitious."

Macao: Growth But Margin Pressure

Macao operations grew Adjusted Property EBITDA 6.5% to $608 million, but margins remain under pressure.

Hold-adjusted margin reality: If Macao had held as expected, EBITDA would have been $26 million lower, putting the adjusted margin at 28.9% — down 390 basis points versus Q4 2024.

Patrick Dumont explained the strategy: "We sort of think about this business as a low 30s margin business. If the base mass comes back like it existed pre-pandemic, that's a very high-margin business, and our margin structure can change positively."

Rolling segment surged: Rolling volumes jumped 60% year-over-year as the company attracted foreign play from across Asia. Grant Chum, CEO of Sands China, noted: "We've been very successful in attracting the foreign play out of the rest of the Asian markets... and that super VIP rolling segment this quarter as well."

Non-rolling hold headwind: Against prior quarter and prior year, non-rolling hold percentage was lower by about 140 basis points, also impacting results.

Base mass weakness persists: Spend per customer in lower-value segments "has been on a declining trend versus pre-COVID" and "has been quite stagnant" even as GGR accelerated. Property visitation slightly exceeded 2019 levels, approaching 100 million visits in 2025, but this hasn't translated to base mass revenue growth. To address this, the company is leveraging retail mall attractions, the event calendar, and has introduced "new non-gaming loyalty programs into the market, particularly for the retail mall business" with "good take-up and success."

How Did the Stock React?

Regular hours: LVS closed at $61.24, up 1.5% ahead of the report.

After-hours: Shares fell to approximately $56.79, down ~7% from the close.

The negative reaction despite the beat may reflect:

- Macao margin compression — Hold-adjusted margin of 28.9%, down 390 bps YoY

- Premium mix shift — Higher rolling and premium mass business is lower margin

- Promotional intensity — Management acknowledged the environment "remains intense"

What Did Management Say About Macao's Path Forward?

Management set expectations for a $700 million quarterly EBITDA target and long-term return to $2.7-2.8 billion annually.

Londoner Grand ramp-up: Marketing strategies leveraging the Londoner Grand launch since May are "moving in the right direction in terms of customer growth, in terms of revenue growth, across all the segments."

Promotional stabilization: Grant Chum offered cautious optimism: "Seeing what we saw in Q4, I think we're reaching a level where there is some stability in terms of the way we see our promotional intensity. We actually hope to be able to optimize some of that across the different segments into 2026."

Side bets progress: The company is rolling out additional wager options on baccarat, though participation isn't at Singapore levels. "It is on an increasing trend. We'll continue to innovate in terms of offering more fun and interesting side wager options."

NBA partnership success: The NBA China Games Week was "the biggest event that we conducted ever in the history of the company" — successful for brand projection and customer engagement, with a multi-year continuation planned.

2026 outlook: "2026 is gonna be a year where we sustain our revenue growth against the market, and then hopefully convert more of that into EBITDA."

CEO Transition: Rob Goldstein to Senior Advisor

At the call's conclusion, Patrick Dumont announced that Rob Goldstein will serve as senior advisor for the next 2 years after 30 years of leadership:

"On behalf of the company's board of directors, the senior leadership team, all of our team members, I want to thank Rob for 30 years of extraordinary contributions... Rob and Sheldon had a wonderful friendship and achieved so much together. On behalf of Dr. Adelson and the family, thank you, Rob, for everything you've given this company."

Goldstein's final words on the call: "Promise better margins in Macau. Stay the course."

Multiple analysts on the call offered personal congratulations, underscoring Goldstein's impact on the gaming industry.

What About Capital Returns?

LVS continues to aggressively return capital to shareholders:

Q4 2025 Actions:

- $500 million in share repurchases

- $0.25 per share quarterly dividend paid

- $66 million in SCL share purchases, increasing LVS ownership to 74.8%

Dividend Increase Announced: The Board approved a 20% dividend increase for 2026, raising the annual dividend to $1.20 per share ($0.30 quarterly), up from $1.00 in 2025.

Capital allocation philosophy: Patrick Dumont noted the company sees value in both LVS and SCL shares. "We do think the dividend is fundamental to our return on capital story... You should see us heading forward in this general direction. We've been pretty aggressive in the way that we buy back shares."

Q&A Highlights

On World Cup 2026 concerns: Goldstein dismissed worries that the tournament would impact traffic: "I don't believe it matters at all. They can watch it on the telephone... That's been overblown in the past and overrated."

On Japan opportunities: "If Japan were ever to present an investment opportunity that worked for us, we'd consider it. But right now, we're really focused on investing on our existing properties, building IR two."

On MBS seasonality: Goldstein pushed back on seasonal modeling: "I don't think it's seasonal... It's less seasonally driven, I think, and more driven by the building itself and a strong market. I wouldn't model it based on that."

On wage inflation: Annual wage adjustments occur in March, with increases planned for 2026 frontline staff.

On Chinese New Year demand: Patrick Dumont declined to comment on the current quarter but offered encouragement: "If you look at the growth in the Macau market overall, it's been very encouraging. The type of players that are coming in, the value of those patrons, it is premium focused, but it's very encouraging."

What Changed From Last Quarter?

Key Risks and Concerns

-

Base mass stagnation — Spend per visitor in lower-tier segments remains weak despite property visitation exceeding 2019 levels

-

Hold variance reliance — Q4 results benefited from $71 million in favorable hold across both markets; normalized margins would have been materially lower

-

Promotional intensity — Environment "remains intense, especially in the premium segments" with month-by-month variability

-

Leadership transition — Rob Goldstein's move to advisor role after 30 years creates uncertainty, though Patrick Dumont has been COO

-

Singapore tax headwind — Higher mass gaming tax rate triggered in July, ~$44M quarterly impact

Balance Sheet Snapshot

As of December 31, 2025:

The balance sheet remains healthy with significant liquidity to fund the MBS expansion project ($8 billion total cost, estimated opening January 2031).

The Bottom Line

Las Vegas Sands delivered a strong Q4 beat driven by a record quarter in Singapore, where Marina Bay Sands posted $806M in EBITDA — what departing CEO Rob Goldstein called "the greatest quarter in the history of casino hotels." The 20% dividend increase signals confidence, and Macao showed stabilizing promotional intensity with hope for margin recovery in 2026. However, hold-adjusted Macao margins down 390 bps YoY and persistent base mass weakness gave investors pause, with shares falling ~7% after-hours. As Goldstein transitions to advisor after 30 years, his parting message was clear: "Promise better margins in Macau. Stay the course."

Estimates data from S&P Global. Market data as of market close January 28, 2026.